What is Best Time for Intraday Trading?

What is the Best Time for Intraday Trading?

Discover the optimal timings for intraday trading and boost your success in the stock market. Learn the ins and outs of the best time for intraday trading, supported by expert insights and first-hand experiences.

Introduction

Intraday trading, a thrilling venture in the world of stocks, demands precision and strategy. Understanding the best time for intraday trading is crucial for maximizing profits and minimizing risks. This comprehensive guide delves into the intricacies of intraday trading, providing valuable insights and expert recommendations.

Between 10.15 a.M. And 2.30 p.M.

The Best Time Frame for Intraday Traders

The best time for intraday trading, in keeping with inventory marketplace analysts, is among 10.15 a.m. and 2.30 p.m. This is due to the fact through 10.00 a.m. to 10.15 a.m., morning inventory volatility has subsided.As a result, it’s far the perfect possibility to vicinity an intraday transaction.

The Dynamics of Intraday Trading

The Essence of Intraday Trading

Embark on the journey of intraday trading, where stocks are bought and sold within the same trading day. This fast-paced approach requires a deep understanding of market dynamics and, most importantly, impeccable timing.

Unveiling the Market Opening

The Kickstart: Unravel the opportunities and challenges associated with the market opening. Discover why seasoned traders consider the first hour crucial for setting the tone of the day.

The Midday Momentum

Riding the Wave: Explore the midday market surge and how traders leverage momentum during this period. Understand the psychological aspects that influence stock movements.

Navigating Through Lunchtime

The Lull Before the Storm: Learn about the nuances of trading during lunchtime. Discover whether it’s a period of rest or a hidden opportunity for savvy intraday traders.

Closing the Day

The Final Sprint: Delve into the intricacies of the closing hours. Uncover why the last hour of trading holds unique prospects for those with the acumen to seize them.

What is Best Time for Intraday Trading?

Market Volatility and Intraday Trading

Riding the Waves: Understand the correlation between market volatility and successful intraday trading. Learn to navigate through price fluctuations and capitalize on volatility.

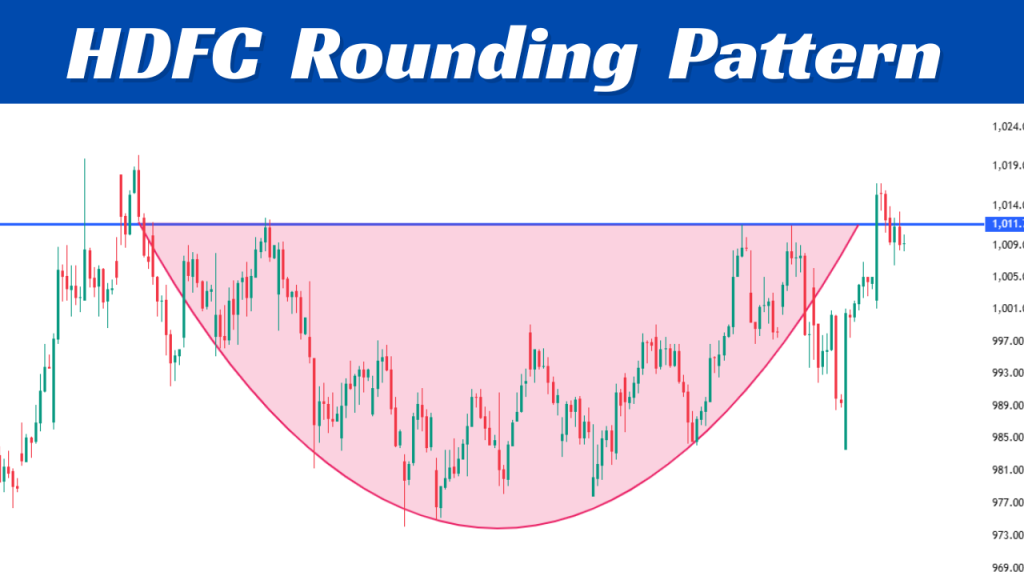

Analyzing Historical Data

Back to the Future: Explore the significance of historical data in determining the best time for intraday trading. Gain insights into how past trends can guide your present decisions.

Economic Indicators' Impact

Beyond Numbers: Delve into the influence of economic indicators on intraday trading. Understand how events on a global scale can create ripples in the stock market.

FAQs About Intraday Trading

Are There Universal Best Times for Intraday Trading?

Intraday trading is dynamic, and the best times can vary. Factors like market conditions and personal preferences play a role. It’s advisable to analyze your trading style and the market’s behavior before determining your optimal time.

Can Beginners Succeed in Intraday Trading?

Absolutely. Beginners can thrive in intraday trading with the right knowledge and approach. Start with small investments, educate yourself, and gradually increase your exposure as you gain experience.

Is Intraday Trading Risky?

Like any investment, intraday trading carries risks. However, with a well-thought-out strategy, risk management, and continuous learning, traders can mitigate potential losses and increase their chances of success.

How Can I Identify the Best Stocks for Intraday Trading?

Conduct thorough research, analyze historical data, and keep an eye on market trends. Focus on liquid stocks with high volatility and tight bid-ask spreads. Utilize technical and fundamental analysis for a comprehensive view.

What Role Does Emotional Control Play in Intraday Trading?

Emotional control is paramount in intraday trading. Fear and greed can cloud judgment. Establish clear entry and exit points beforehand, stick to your strategy, and avoid impulsive decisions.

Are There Tools or Software That Can Aid Intraday Trading?

Yes, various tools and software are designed to assist intraday traders. From charting platforms to real-time market data, utilizing these resources can enhance your decision-making process.

Conclusion

Intraday trading’s success hinges on mastering the art of timing. By understanding the dynamics of the market throughout the day, analyzing historical data, and staying informed about economic indicators, traders can position themselves for success. Remember, there’s no one-size-fits-all approach, so tailor your strategy to your risk tolerance and trading style.